What is the Operating Cash Flow Ratio?

Operating Cash Flow Ratio

A liquidity ratio that measures a company's ability to pay off its current liabilities with its cash flow

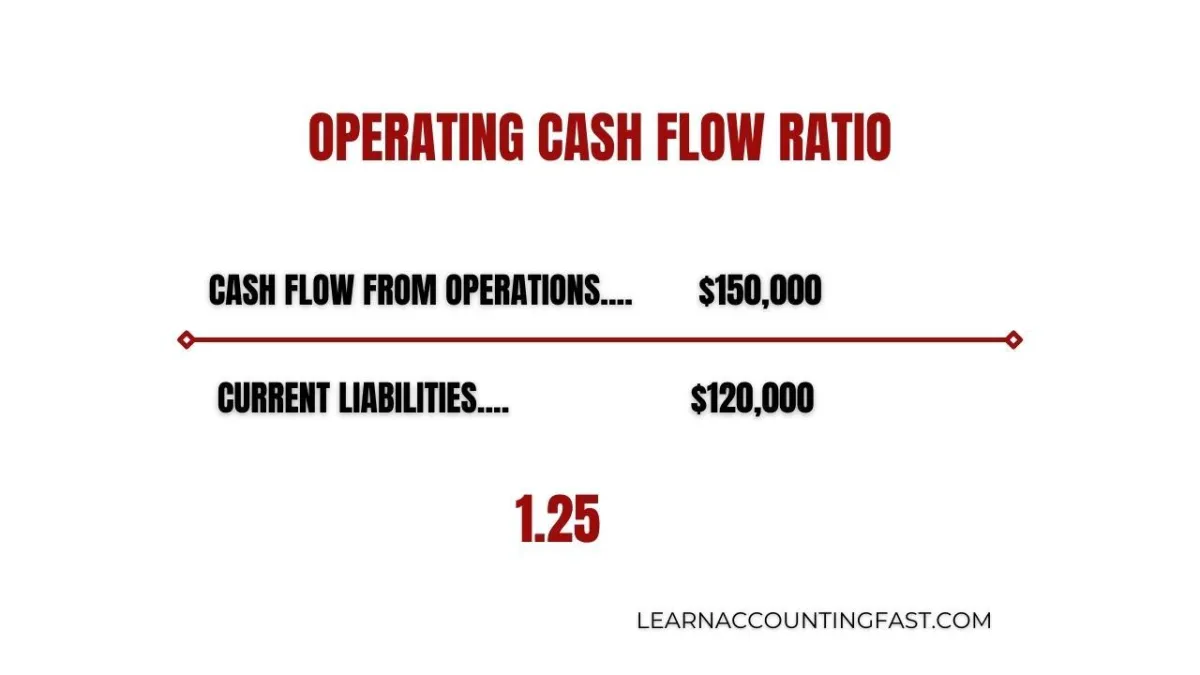

Operating Cash Flow Ratio equals. Cash flow from operations divided by Current Liabilities.

What is the Operating Cash Flow Ratio?

The Operating Cash Flow Ratio, is a liquidity ratio, its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations.

Cash flow from operations can be found on a company’s cash flows statement .

Current liabilities are obligations due within one year. Examples include short-term debt, accounts payable, and accrued liabilities.

Accrued liabilities are liabilities that reflect expenses that have not yet been paid or logged under accounts payable

( Money Owed to suppliers) during the accounting period.

What is Cash Flow From Operations?

It is important to understand Operating Cash Flow as this is the numerator of the operating cash flow ratio.

Operating cash flow, is one of the most important numbers in a company’s accounts.

It reflects the amount of cash that a business produces solely from its core business operations.

What does it all mean?

Operating cash flow is intensely scrutinised by investors, as it provides vital information about the health and value of a company.

If a company fails to achieve a positive Operating Cash Flow, the company cannot remain solvent in the long term.

A negative Operating Cash Flow, indicates that a company is not generating sufficient cash flow from its core business operations, and therefore needs to generate additional positive cash flow from either financing or investment activities.

Interpretation of Operating Cash Flow Ratio

A ratio less than ONE indicates short-term cash flow problems.

This signals short-term problems and a need for more Cash.

A ratio greater than ONE indicates good financial health.

Indicating the cash flow is more than sufficient to meet the short-term

financial obligations.

Companies with a high operating cash flow are generally considered to be in good financial health.

This liquidity ratio is considered an accurate measure of short-term liquidity, as it only uses cash generated from

core business operations rather than from all income sources.

Cash is Blood to a Business.. No Blood and You die

Next, The Leverage Ratios.

What are they? How to evaluate them? and how to use this information to support you to be the greatest you can be.

The content shared on this blog and in these videos is for informational and educational purposes only.

Despite my 30 years of experience as a business owner, I am not a certified financial advisor, accountant, or legal

professional.

The insights and tips shared are based on personal experiences and should not be taken as professional financial or legal advice.

For financial, legal, or professional advice, please consult with a certified professional in the respective field.

I disclaim any liability or responsibility for actions taken based on any information found in this blog or these videos.

More to Explore

Accounting Best Practices for E-commerce Entrepreneurs

Running an e-commerce business requires precise financial management. Without a structured accounting system, cash flow issues, tax penalties...

Implementing AI on a Budget A Guide for Small Businesses

Artificial Intelligence (AI) is no longer just for big corporations with deep pockets.

Small businesses can now leverage AI tools .....

10 Secrets of Old

Money Families

It was a crisp autumn morning when Sarah first set foot in her

grandfather's study. The room smelled of leather and old books, with sunlight streaming through tall windows...

Integrating Blockchain Technology into Modern Accounting

This guide provides a detailed, step-by-step process for integrating blockchain into your accounting practices, enhancing transparency....

How to Use AI to Automate a Small Business Operation

Artificial Intelligence (AI) is no longer just for large corporations; small businesses can use AI tools to save time, reduce costs, and increase efficiency....

Cryptocurrency and Business Taxes: Advanced Strategies for Staying Ahead

Cryptocurrency is revolutionizing business and investment, but those who truly excel in this space know it’s not just about understanding the basics....

Disclaimer: The content shared on this blog and in these videos is for informational and educational purposes only. Despite my 30 years of experience as a business owner, I am not a certified financial advisor, accountant, or legal professional. The insights and tips shared are based on personal experiences and should not be taken as professional financial or legal advice. For financial, legal, or professional advice, please consult with a certified professional in the respective field. I disclaim any liability or responsibility for actions taken based on any information found in this blog or these videos.

Copyright Learn Accounting Fast - All Rights Reserved 2025

Facebook

Instagram

X

LinkedIn

Youtube