Stop Guessing Where Your

Money Went

A simple 15-minute weekly system to stop cash surprises and know what to do next.

See what's happening with your cash — without a finance degree

Know the 3–5 actions to do this week

Feel calm and confident talking about your business

Cash surprises are not "bad luck."

They are missing checks.

If you've ever:

Made sales… but cash still feels tight

Felt confused by a P&L, cash flow, or balance sheet

Avoided looking at reports because it feels too hard

You're not alone.

The real problem is this: You don't have a simple weekly system.

What if you could get clarity in 15 minutes a week?

Imagine this:

You know where cash is going

You can spot trouble early

You have a short list of next

steps every week

That's financial literacy for business owners in real life.

The Stop Guessing Money Kit is your weekly money "check engine light."

It's a bundle of templates and checklists written in simple words.

You follow the steps. You fill in a few numbers. You get your answer:

"Here's where I am, and here's what to do next."

This is one of the most practical skills for business success you can build.

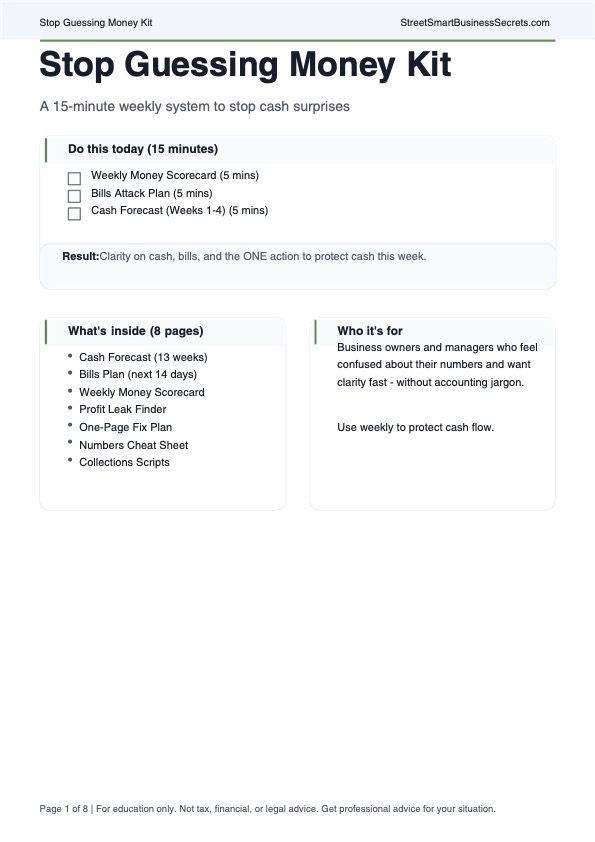

What you get

Daily mini-checks

Keep control with quick daily checks

Weekly 15-minute review

The main system that changes everything

Simple prompts

So you're never stuck wondering

what to do

How to use your stop guessing money kit in just (15 minutes)

Gather 3 numbers (2 minutes)

Cash in bank

Bills due soon

Sales money coming in

Do the "Cash Clarity" check (5 minutes)

What's coming in

What's going out

What's left

Read the simple signals (4 minutes)

Are you safe?

Are you tight?

Are you in danger?

Pick your next actions (4 minutes)

Cut one cost

Chase one payment

Raise one price

Delay one expense

Click the image

This is cash flow management tips

now a repeatable weekly habit.

This is for you if…

Perfect for you if:

You run a small business and want simple money clarity

You feel unsure reading reports

You want weekly actions, not theory

Not for you if:

You want complicated spreadsheets and deep accounting rules

You won't spend 15 minutes a week

What changes when you use it

Fewer cash surprises

No more wondering where the money went

Clear weekly actions

Know exactly what to do next

More confidence

Talk about your business with certainty

Better decisions

Balance growth and cash effectively

This helps with balancing growth and profitability because you see what your money can really support.

Built for Real Business Owners

I built this because I saw too many smart business owners feeling lost when it came to their numbers. You don't need a finance degree — you need a simple system you

can actually use.

Educational resource only. Not financial advice. Results may vary.

Get the Stop Guessing Money Kit

$17

Templates + checklists

15-minute weekly system

Instant download

Secure checkout. Instant access.

STILL NOT SURE?

Frequently Asked Questions

Question 1: Is this accounting software?

No. It's a simple set of templates and checklists you fill out.

Question 2: Do I need to understand financial reports first?

No. This is built to teach you as you go, in simple words.

Question 3: How long does it take each week?

About 15 minutes.

Question 4: Will this replace my accountant or bookkeeper?

No. It helps you understand what's going on so you can ask better questions.

Question 5: What if my business is very small?

That's fine. The system works even if you only have a few sales.

Question 6: Is this financial advice?

No. This is education only.

Question 7: Is this a one-time payment?

Yes. One-time purchase for the kit.

Question 8: How do I get the download?

Right after checkout, you'll get instant access.